AI Trading Bot Assistant: Smarter Trades or Systemic Time Bomb?

AI Trading Bot Assistant: Smarter Trades or Systemic Time Bomb?

In recent years, modern AI trading robot assistant have leveraged advanced machine learning techniques, natural language processing, and predictive analytics to execute trades with a level of precision and speed that human traders cannot match. However, as with any technological advancement, the rise of AI trading robot assistant presents both great opportunities and significant challenges that deserve careful scrutiny. In this blog post, I will explore the evolution, capabilities, limitations, and ethical considerations of these powerful trading tools that are reshaping the financial world.

How Have AI Trading Robot Assistant Evolved Over Time?

The evolution of AI trading robot assistant from basic software to full-fledged trading partners is fascinating. Let’s trace this evolution through its key development stages and milestone products.

Early Days: Rule-Based Systems

Initially, the AI trading robot assistant we know today were just automated trading systems that followed predefined rules. These early prototypes appeared in the early 2000s and operated based on basic if-then conditions.

These early systems could perform simple tasks, such as executing trades when certain technical indicators reached predetermined levels. However, they lack adaptability and require constant manual adjustments as market conditions change.

The Machine Learning Revolution

The real revolution began around 2018, when machine learning techniques were integrated into trading bots:

- Numerai: Created a hedge fund based on predictions from machine learning models submitted by data scientists around the world

During this phase, AI trading bot assistant evolved from machines that followed the rules to learning systems that could identify patterns in historical data and predict future market movements. This represented a huge leap in capabilities - these systems could now discover trading strategies that human analysts might never have thought of.

Contemporary: Ensembled AI Systems

Today’s AI trading bot assistant represents the culmination of decades of development, combining multiple AI technologies:

- Deep Learning Pattern Recognition: Identify complex market patterns across multiple time frames

- Natural Language Processing: Analyze news, social media, and financial reports to gain insights into market sentiment

- Reinforcement Learning: Optimize trading strategies through trial and error

- Ensemble Methods: Combine multiple models to improve forecast accuracy

Modern platforms such as QuantConnect, Alpaca, and TradeStation have incorporated these technologies to create a comprehensive ecosystem of AI trading bot assistant that handle everything from market analysis to order execution.

The move from simple automation to true AI has transformed these tools from mere human strategy executors to creative partners capable of discovering novel trading approaches.

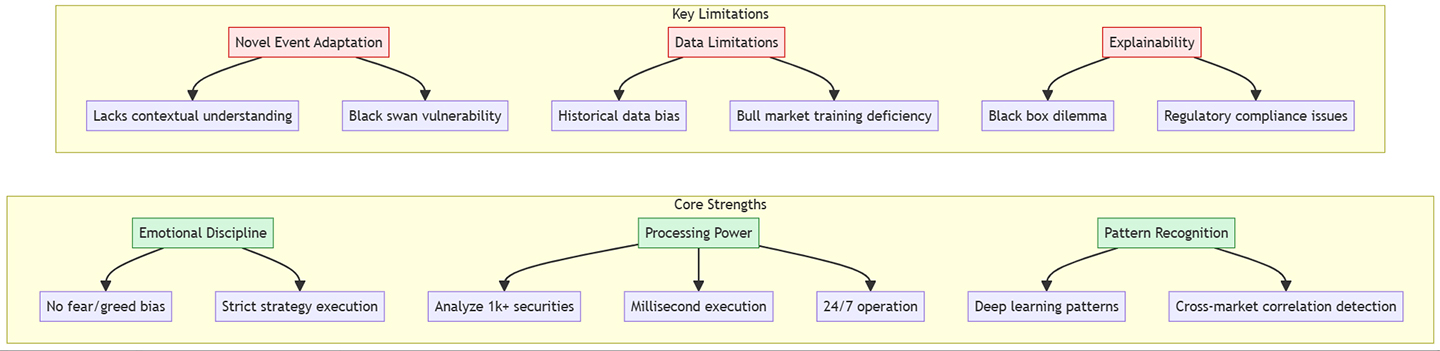

What Are the Strengths and Limitations of AI Trading Bot Assistants?

As with any technology, AI trading bot assistant comes with distinct advantages and limitations that traders must consider carefully.

Undeniable Strengths

Emotional Discipline

Perhaps the most significant advantage of AI trading bot assistant is their immunity to psychological biases that plague human traders. Fear, greed, and overconfidence have ruined countless trading careers, but AI systems execute their strategies with perfect discipline.

I've observed numerous cases where human traders abandoned their strategies during market volatility, while AI trading bot assistant maintained course and captured opportunities that human emotion would have missed.

Processing Power and Speed

The computational capabilities of AI trading bot assistant far exceed human capacity:

- Data Analysis: Modern AI systems can simultaneously analyze thousands of securities across multiple markets

- Execution Speed: Trades can be executed in milliseconds when opportunities arise

- 24/7 Operation: Unlike human traders, AI systems can monitor markets continuously without fatigue

This processing advantage allows AI trading bot assistant to capitalize on fleeting market inefficiencies that would be impossible for humans to detect and act upon manually.

Pattern Recognition

AI trading bot assistant excel at identifying complex patterns across historical data sets. Through deep learning techniques, these systems can recognize subtle correlations between various market factors that might escape even the most experienced human analysts.

For example, an AI system might detect that a specific combination of technical indicators, macroeconomic data, and news sentiment consistently precedes a price movement in a particular asset class—a pattern too complex for human observation.

Significant Limitations

Adaptation to Unprecedented Events

Despite their sophistication, AI trading bot assistant struggle with truly novel situations. When faced with unprecedented market conditions or "black swan" events, these systems may lack the contextual understanding and adaptive reasoning that experienced human traders possess.

Data Limitations and Biases

AI trading bot assistants are only as good as the data they learn from. If historical data contains biases or is insufficient to represent certain market conditions, the AI will inherit these limitations.

I've analyzed cases where AI systems trained primarily on bull market data performed poorly during bearish phases because they lacked sufficient examples of downward trends in their training sets. This limitation requires human oversight to ensure the AI has been exposed to diverse market conditions.

Explainability Challenges

Many advanced AI trading bot assistant, particularly those using deep learning, function as "black boxes." This lack of transparency makes it difficult to understand exactly why a system makes certain trading decisions, creating a significant challenge for risk management and regulatory compliance.

When an AI system unexpectedly loses money, the inability to clearly explain its decision-making process can leave traders and investors frustrated and hesitant to trust the technology for future trades.

How are AI trading bots impacting industries?

The impact of AI trading bots goes far beyond individual traders, it is reshaping the entire financial ecosystem and beyond.

Transformative impact on financial services

Democratization of complex trading

AI trading bots break down the barriers that once only institutional investors had access to advanced trading strategies. Today, retail investors can gain access to AI trading capabilities comparable to those of large financial institutions:

- Retail trading platforms: Services such as Alpaca, QuantConnect, and Trality allow ordinary investors to build or subscribe to AI trading strategies

- Asset management: Robo-advisors such as Betterment and Wealthfront use AI to manage portfolios at a fraction of the cost of traditional investing

This democratization is reshaping the investment management landscape, forcing traditional financial advisors to demonstrate value beyond what AI can offer.

Employment transformation in financial services

The rise of AI trading bots is leading to the loss and transformation of a large workforce:

- Traditional trading jobs: Simple jobs working on trading floors will be replaced or transformed by automation and AI.

- New Opportunities: At the same time, demand for data scientists, machine learning engineers, and AI experts has surged among financial firms.

Rather than experiencing a net loss of jobs, the financial industry has experienced a dramatic shift in the skills required. Financial professionals increasingly need technical expertise and market knowledge to remain competitive.

Wider Economic Impact

Market Liquidity and Stability

AI trading bot assistant significantly increase market liquidity by continuously providing buy and sell orders. However, their synchronized response to market signals can sometimes exacerbate market volatility:

- Flash Crashes: When multiple AI systems react to the same trigger, their collective actions can accelerate market volatility.

- Correlated Risk: As more and more capital is managed by similar AI algorithms, the risk of synchronized market movements increases.

Regulators like the U.S. Securities and Exchange Commission (SEC) are increasingly interested in understanding how AI trading affects market stability and developing appropriate regulatory mechanisms.

Alternative Data Industry Growth

AI trading robot assistant's thirst for data has driven explosive growth in the alternative data industry:

- Market Size: The alternative data market size will continue to expand.

- Data sources: Companies now collect information from satellite imagery, social media sentiment, credit card transactions, and countless other sources to feed AI algorithms.

This has given rise to a whole new economic sector dedicated to collecting, processing, and packaging data for use by trading algorithms.

What Ethical Concerns Do AI Trading Bot Assistants Raise?

The rapid advancement of AI trading bot assistant brings several profound ethical questions that demand careful consideration.

Market Fairness and Accessibility

The sophisticated capabilities of AI trading bot assistant raise concerns about creating a two-tiered market where those with access to advanced technology have insurmountable advantages:

- Computational Advantages: High-frequency trading firms with superior hardware and proximity to exchanges can execute trades in microseconds

- Data Asymmetries: Institutional investors can afford premium data sources unavailable to retail traders

This technological divide threatens the foundational principle of fair markets. While some argue that competition drives innovation, others contend that without regulatory intervention, markets will become increasingly inaccessible to average participants.

Algorithmic Accountability

When AI trading bot assistant malfunction or behave in unexpected ways, determining responsibility becomes complicated:

- Developer Responsibility: Should algorithm creators be held accountable for unforeseen consequences?

- User Responsibility: Do traders using these systems bear ultimate responsibility for their actions?

- Platform Accountability: What obligations do trading platforms have to prevent harmful algorithmic behavior?

The "black box" nature of many AI systems makes accountability even more challenging. This opacity can shield bad actors from responsibility while leaving victims without recourse.

Systemic Risk and Market Manipulation

The concentration of capital managed by AI systems creates potential for systemic risk:

- Cascade Failures: Interconnected AI systems responding to each other could trigger market-wide disruptions

- Manipulation Vulnerability: Bad actors might exploit predictable patterns in AI behavior to manipulate markets

According to a report by the Bank for International Settlements, AI-driven trading now accounts for approximately 70% of daily trading volume in US equity markets, creating significant potential for systemic impacts when these systems malfunction or are manipulated.

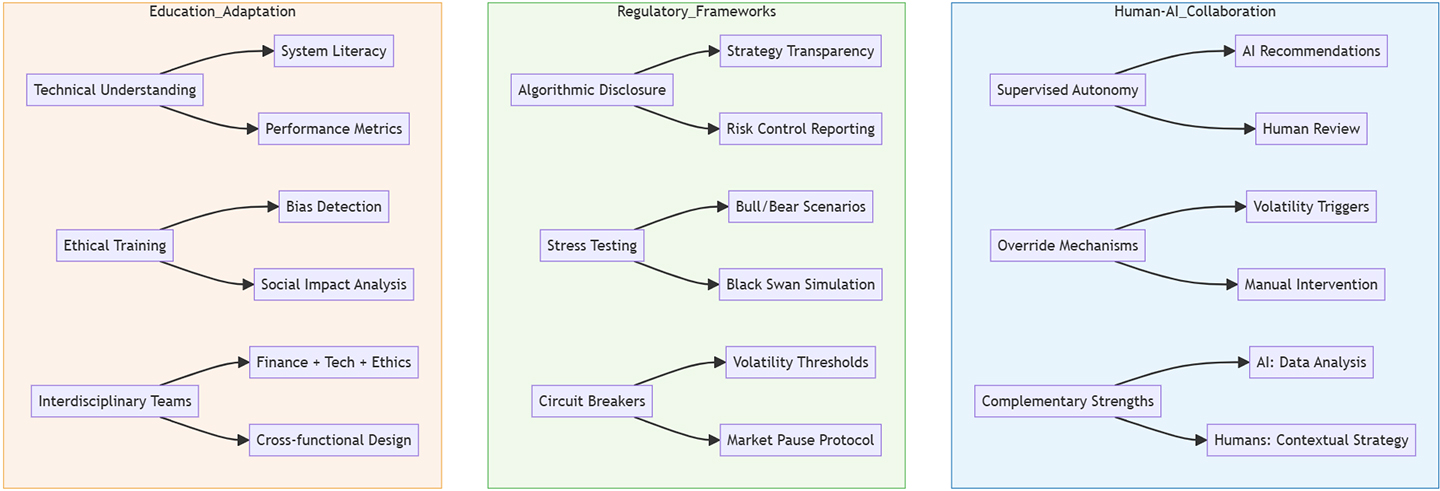

How Can We Responsibly Utilize AI Trading Bot Assistants?

Despite the challenges, there are practical approaches to harnessing the power of AI trading bot assistant while mitigating their risks.

Human-AI Collaboration Models

Rather than viewing AI as a replacement for human traders, the most successful approaches employ collaborative models:

- Supervised Autonomy: AI systems generate trading recommendations that human traders review before execution

- Override Mechanisms: Human supervisors maintain the ability to intervene during unusual market conditions

- Complementary Strengths: AI handles data-intensive analysis while humans provide contextual judgment and strategic direction

This approach leverages the computational power of AI trading bot assistant while maintaining human judgment for exceptional circumstances and ethical considerations.

Regulatory Frameworks for AI Trading

Effective governance of AI trading bot assistant requires updated regulatory approaches:

- Algorithmic Disclosure: Requiring transparency about general trading strategies and risk controls

- Stress Testing: Mandatory testing of AI systems under various market scenarios

- Circuit Breakers: Market-wide pauses when volatility exceeds certain thresholds

The European Union's AI Act represents one of the first comprehensive attempts to regulate AI systems, including those used in financial markets. Similar frameworks are needed globally to ensure these powerful tools benefit society broadly.

Continuous Education and Adaptation

For individuals and organizations working with AI trading bot assistant, ongoing education is essential:

- Technical Understanding: Even non-technical users need basic comprehension of how their AI systems function

- Ethical Training: Developers should receive training on potential societal impacts of their algorithms

- Interdisciplinary Collaboration: Bringing together financial experts, technologists, and ethicists to design better systems

By fostering this knowledge ecosystem, we can develop AI trading bot assistant that serve human needs while respecting important ethical boundaries.

Frequently Asked Questions About AI Trading Bot Assistant

Q: Is AI trading bot assistant profitable for average investors?

A: While AI trading bot assistant is powerful, profitability depends on a variety of factors, including strategy quality, market conditions, and proper implementation. Average investors should have realistic expectations - some studies show that around 30-40% of AI trading strategies outperform simple buy-and-hold strategies over the long term. Success usually requires some technical knowledge or working with a provider that can handle complex issues.

Q: How much money do I need to get started with AI trading bot assistant?

A: Capital requirements have dropped significantly in recent years. While institutional AI trading systems may manage billions of dollars in funds, retail investors can now get started with just $500 to $1,000 on platforms such as Alpaca or QuantConnect. However, users should consider that transaction costs can significantly impact returns on small portfolios.

Q: Can AI trading bot assistant Predict Market Crashes?

A: AI trading bot assistant can identify increasing risk factors before a market downturn, but they cannot accurately predict the exact time or size of a market crash. Their effectiveness is limited by the rarity of major crashes in historical data (there are few cases to draw on) and the uniqueness of each crisis. Most sophisticated systems include risk management protocols rather than trying to precisely time a market exit.

Q: What programming skills are needed to create an AI trading bot assistant?

A: Creating a basic AI trading bot assistant generally requires an understanding of financial markets, statistics, and machine learning concepts are also essential. However, many platforms now offer no-code or low-code environments where users can build strategies through a graphical interface, making this technology more accessible to non-programmers.

Conclusion: The Future of AI Trading Bot Assistants

As we look ahead, AI trading bot assistant will continue to evolve in sophistication and accessibility. I expect several key developments to shape this landscape:

First, increased democratization will bring these tools to broader audiences through simplified interfaces and education. The technical barriers that once restricted algorithmic trading to institutions are rapidly falling.

Second, regulatory frameworks will mature as governments recognize both the benefits and risks of AI in financial markets. These regulations will likely demand greater transparency while still allowing innovation.

Finally, I believe we'll see the emergence of more hybrid models where AI and human intelligence complement each other, rather than competing. The most successful trading operations will leverage the unique strengths of both.

The rise of AI trading bot assistant represents one of the most significant transformations in financial market history. By approaching this technology with both enthusiasm for its potential and critical awareness of its limitations, we can harness its power to create more efficient, accessible, and fair financial markets. The future belongs not to those who simply adopt AI, but to those who learn to work alongside it with wisdom and discernment.

Written by

James

"I’m not lazy, I’m on energy-saving mode."

User Reviews

Blog

Client-side Reviews

Reviews

James

"I’m not lazy, I’m on energy-saving mode."

Subscribe to Newsletter

No reviews yet. Be the first to review!